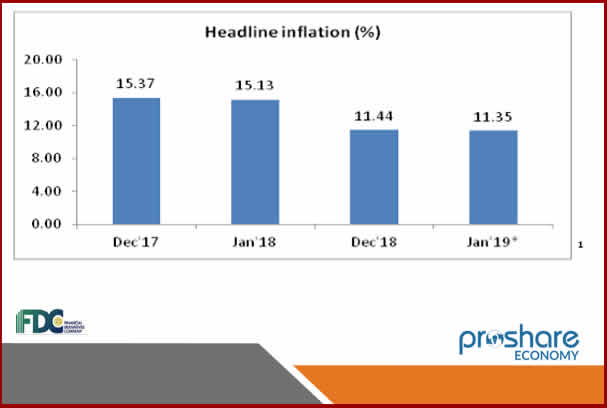

Nigeria’s headline inflation is expected to slide to 11.35% in January from 11.44% in the preceding month. This is likely to be a reflection of a fall in disposable income in January, leading to a decline in aggregate demand for consumer goods. The pattern of slow demand early in the year is seasonal and is empirically validated. In recent times, January inflation numbers have declined, as shown in the graph below. This validates that the assertion in personal income compression in January is partly because of the payment of school bills and the post Christmas expenditure effect. Proshare Nigeria Pvt. Ltd. The moderation in the headline inflation would come as a relief to policymakers who are concerned that inflation will continue its upward movement which started in November. Notwithstanding, the inflation number is still a mile away from the CBN’s comfort zone of 6-9%.

Month-on-Month Price Index Down

The month-on-month inflation (which is more reflective of current prices) is projected to decline to 0.72% (8.96% annualized) from 0.74% (9.31% annualized) in December 2018. This we believe will be driven by the fall in the prices of the food basket. The most significant is the sharp drop in the price of onions which declined to N18,000 per sack after staying stubbornly high at above N30,000 per sack for five months. Proshare Nigeria Pvt. Ltd. Money Supply Down

Money supply growth in January was constrained by factors including lower FACC disbursements, increased OMO activities and the introduction of the stabilization securities. Total FAAC disbursements in January was 20.12% lower at N649.2bn, an indication of a fall in government spending. Similarly, efforts to mop up liquidity saw a 31.49% increase in OMO sales to N2.38trn and the introduction of stabilization securities (N50.24bn)–10% of money supply. This reduction in market liquidity is evident in the sharp drop of 42.87% in banks’ average opening position.

Diesel Prices Driving Down Operating Expenses

The 7.69% decline in the retail price of diesel is expected to reduce logistics and distribution costs. This expense item is now responsible for approximately 40% of total operating expenses. Distribution expenses in the top manufacturing companies have been growing. For instance, Dangote cement’s haulage expenses grew by 53% to N63.99bn in 9M’18 from N41.56bn in 9M’17. The decline in diesel prices could reverse the increasing trend in firms’ operating costs.

Exchange Rate Pass-through to Lower Import Costs

The exchange rate appreciated across […]