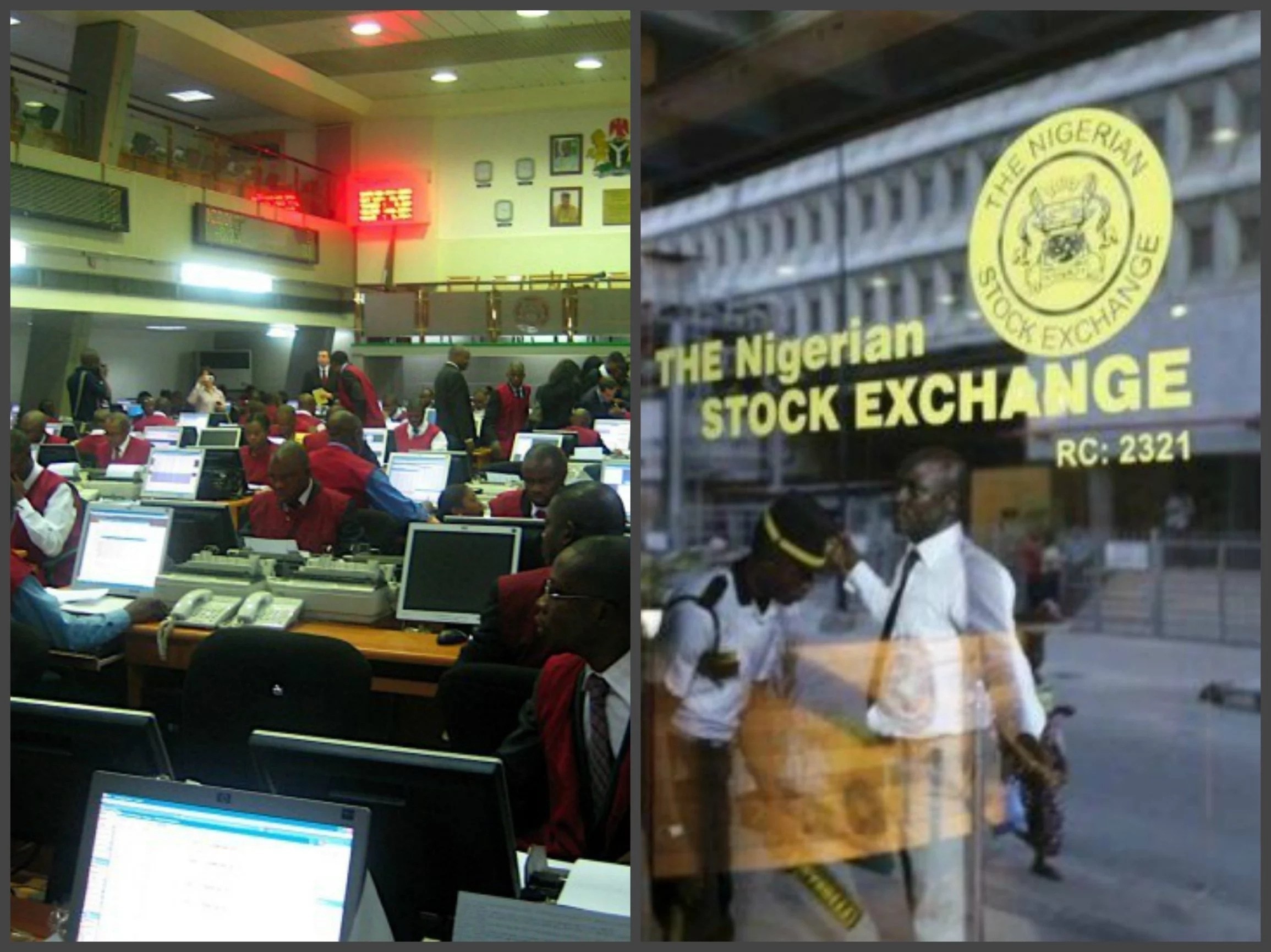

Lafarge Africa has listed additional 7.43 billion shares on the daily official list of the Nigerian Stock Exchange (NSE).

The new shares of the company came from the N89.2 billion rights issue exercise carried out by the cement maker recently, which recorded 100 per cent subscription, according to a recent statement.

The new 7.43 billion ordinary shares of 50 kobo each were sold to existing shareholders of Lafarge Africa at N12 per unit from December 17, 2018 to Monday, January 28, 2018.

With this listing of the additional 7.43 billion ordinary shares on NSE, the total issued and fully paid up shares of Lafarge Africa is now 16.11 billion ordinary shares.

Earlier this month, Lafarge Africa had revealed details of subscriptions of the rights issue, saying 1,826 acceptance forms for 7.43 billion units of the rights issue received were found to be valid under the terms of the exercise and were processed accordingly.

It said 1,734 shareholders accepted their rights issue in full totalling 5.93 billion ordinary shares, out of which 738.73 million ordinary shares were traded on the floor of the NSE.

Also, 92 shareholders with a provisional allotment of 395.875 million ordinary shares partially accepted their rights for 202.40 million ordinary shares.

Lafarge Africa said as a result of the above, the balance of 193.47 million ordinary shares were renounced, with 34 subscribers purchasing rights of 738.73 million ordinary shares on the floor of the NSE.

Chairman, Lafarge Africa, Mr. Mobolaji Balogun, said the additional capital to be raised would further help to deleverage the company’s balance sheet and provide head room for the expansion of its business.

He said the company foresees a stable pricing environment and favourable economic conditions in its Nigeria market, while its South Africa operations were undergoing a turnaround plan.

Chief executive officer, Lafarge Africa, Mr. Michel Puchercos, said the company’s refinancing plan was aimed at preparing for future development in Nigeria by improving the company’s leverage as well as strengthening its profitability.