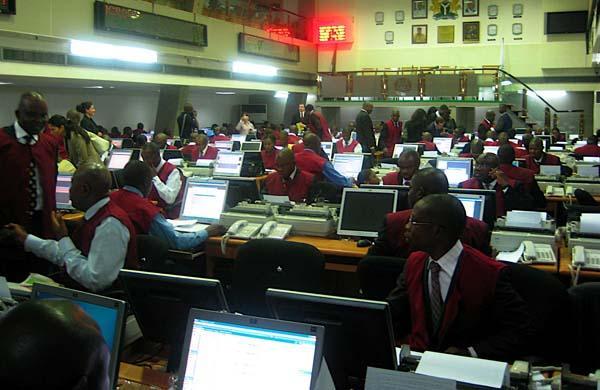

stock market Stock Market Declines 5.9% In August

The Nigerian equities market recorded a decline of 5.86 per cent in the month of August reflecting prevailing negative investors’ sentiments. About 1.63 per cent of the decline was recorded last week as the Nigerian Stock Exchange All-Share Index (NSE ASI) closed lower at 34,848.45.

Although trading has been bearish over the past few months due continued sell down by foreign and domestic investors, analysts said the lower-than-expected gross domestic product(GDP) growth released last week sent negative signals to the market.

“News of the apex Central Bank of Nigeria (CBN)’s fine on Stanbic IBTC Bank and Diamond Bank Plc for illegally repatriating funds on behalf of telecommunications company MTN Nigeria also contributed to the market’s negative sentiments,” analysts at Cordros Capital Limited said.

Four out of the five trading days were negative leading to a week-on-week decline in the NSE ASI. Similarly, market capitalisation depreciated by 1.63 to close at N12.722 trillion. Similarly, all other indices finished lower with the exception of the NSE Consumer Goods and NSE Oil and Gas indices that rose by 0.34 per cent and 0.97 per cent respectively, while NSE ASeM Index closed flat.

“We guide investors to trade cautiously in the short-to-medium term, as the absence of a positive one-off catalyst and brewing political concerns, continue to cast a shadow on our outlook for risky assets. However, the likelihood of recovery in the long term remains supported by stable macroeconomic fundamentals,” analysts at Cordros Capital stated.

Daily Performance

The market had opened the week with a decline of 0.32 per cent thereby failing to sustain the rebound recorded the previous week. The decline on the first day of the week was caused majorly by profit taking in Dangote Cement Plc. Ex-Dangote Cement, the market would have closed 0.43 per cent higher.

The indication that the market would have closed with growth is also reflected in the number of price gainers that stood at 26 as against of 14 price losers. The price losers were led by First Aluminium with 10.0 per cent, trailed by Ikeja Hotel Plc with 9.6 per cent. Universal Insurance Plc followed with 9.0 per cent, while Japaul Oil and Maritime Services Plc shed 7.6 per cent. NSL Technology Plc and UAC of Nigeria Plc went down by 4.7 per cent in that order.

On the positive side, Diamond Bank Plc and Niger Insurance Plc led the price gainers with […]