Kayode Tokede

UAC of Nigeria Plc might not improve on its dividend payout to shareholders in 2021 financial year. This is because analysis of its result and accounts for the year under review revealed that profit after tax and profit before tax dropped by 70.4 per cent and 44.3 per cent respectively in nine months ended September 30, 2021

The leading diversified Company, operating in the Food and Beverage, Real Estate, Paint and Logistics sectors of the economy also reported losses in its third quarter (Q3) unaudited results for period ended September 30, 2021.

In Q3 unaudited results, UAC of Nigeria reported 63.2 per cent drop in Operating Profit to N437 million, with operating profit margin contracting by 386 basis points to 1.8per cent from 5.6 per cent recorded in Q3 2020.

The Group reported loss after tax from continuing operations N199 million in Q3 2021 compared to a N1.2 billion profit in Q3 2020.

Total loss for the period was N199 million in Q3 2021 compared to a profit of N744 million in Q3 2020 as loss per share from continuing operations for Q3 2021 was 9 kobo (Q3 2020: earnings per share of 31 kobo).

The weak performance impacted negatively on its stock price on the Nigerian Exchange Limited (NGX) and Basic Earnings Per Share that dipped to a loss of N0.09 in Q3 2021 from N0.15 recorded in Q3 2020.

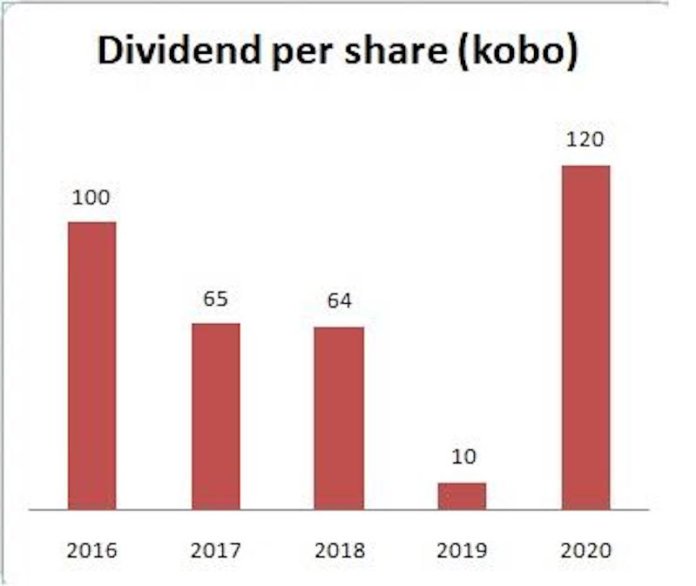

Over the years, UAC of Nigeria maintained mixed performance in dividend payout to shareholders.

For instance, the company reported N3.93billion profit in 2020 from a loss of N9.26billion in 2019 and paid shareholders a dividend of N1.20 (N3.46billion) as against N0.10 dividend in 2019 (N288million) paid to shareholders in 2019.

However, UAC of Nigeria in its nine months result and accounts improved on its revenue but hike in finance cost and operating expenses, two key financial parameters weaken profits in the period under review.

UAC of Nigeria reported 23 per cent increase in revenue to N71.4billion in nine months of 2021 from N57.8billion reported in nine months of 2020.

growth in revenue The growth in revenue was driven by 13.7 per cent increase in Animal Feeds and Other Edibles segment to N41.64billion in nine months of 2021 from N36.65billion reported in nine months of 2020, amid increasing price that offset rising raw material costs.Paints segment grew by 41.3 per cent to N10.2billion from N7.14billion on account of higher volumes compared to 2020 which was […]