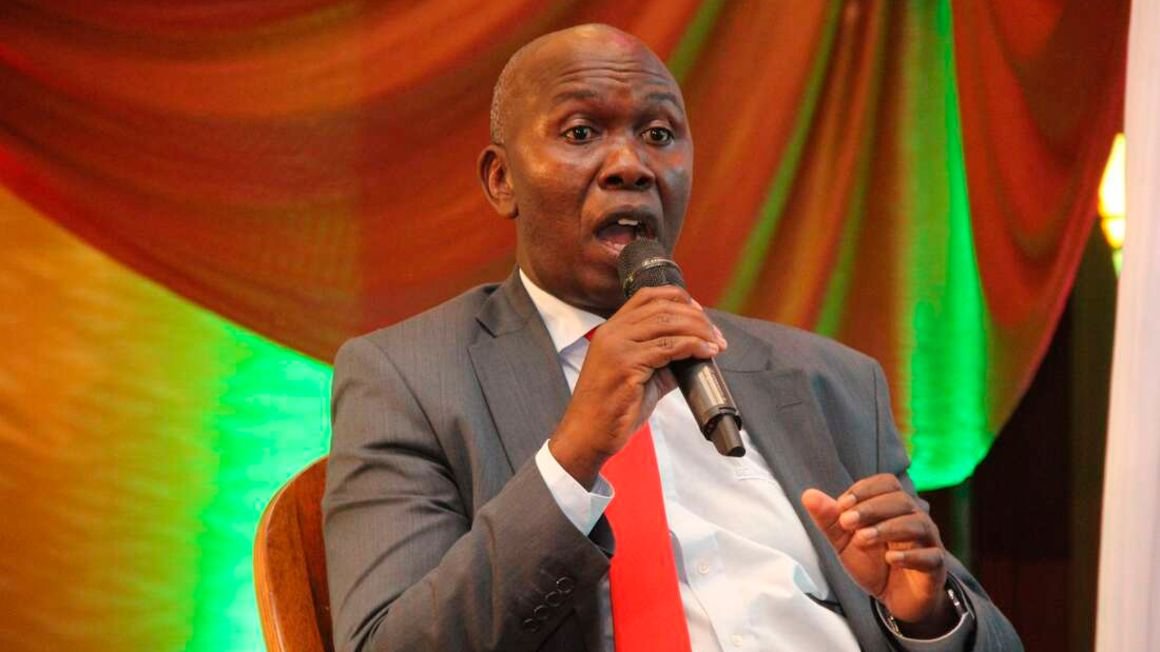

Capital Markets Authority (CMA) CEO Wyckliffe Shamiah at a past event. FILE PHOTO | LUCY WANJIRU | NMG Kenya’s once vibrant corporate bonds market has undergone lean times in the past five years, at times facing real fears of a total collapse due to investors’ fear of losing their funds to shaky issuers.

Although there are now encouraging signs of a gradual recovery, following successful issuances by student hostel developer Acorn Holdings, Family Bank and Centum Real Estate, much still needs to be done if the segment is to recover its lost glory.

The corporate bond market had a portfolio size of Sh71.3 billion and 28 listings in 2014 but has now shrunk to just three investment-grade bonds — the three mentioned above—with a total outstanding value of Sh11.7 billion.

Corporate bonds now account for just 0.13 percent of the NSE’s secondary bonds market turnover that is averaging Sh78.4 billion per month this year (government bonds: 99.87 percent).

Most of the issuers who were in the market in 2014 redeemed their bonds and opted for other alternative sources of funds including loans from banks, shareholders and development finance institutions.

On June 28, EABL made an early redemption of its Sh6 billion bond, nine months ahead of the originally scheduled maturity date of March 28, 2022.

Much of the heavy lifting in the efforts to revive the market will fall on the Capital Markets Authority (CMA), with the market now demanding concrete policy changes to protect investors in case of issuer failure.

Collapsed lenders

It was under the CMA’s watch that investors sunk Sh6.82 billion into bonds issued by Imperial and Chase banks in 2015, only for the two lenders to collapse within the next 10 months and set off the loss of confidence in the corporate bonds segment.

South African SME financier Real People has at the same time been struggling to redeem its overdue bonds worth Sh1.3 billion and has pushed the final maturity to 2028.

Now, the capital markets regulator is eyeing a proposed new fund to breathe new life into the segment, either by guaranteeing new issuers, subsidising the cost of issuance or providing liquidity support at maturity to pay bondholders in case of issuer distress.Luke Ombara, CMA policy and market development director, told Business Daily that the regulator has been planning the fund for some time, guided by the credit guarantee fund that has been offered to the money markets by the Central […]