•The value of premiums are up compared to Sh121.04 billion same period last year, latest data by the Insurance Regulatory Authority indicate.

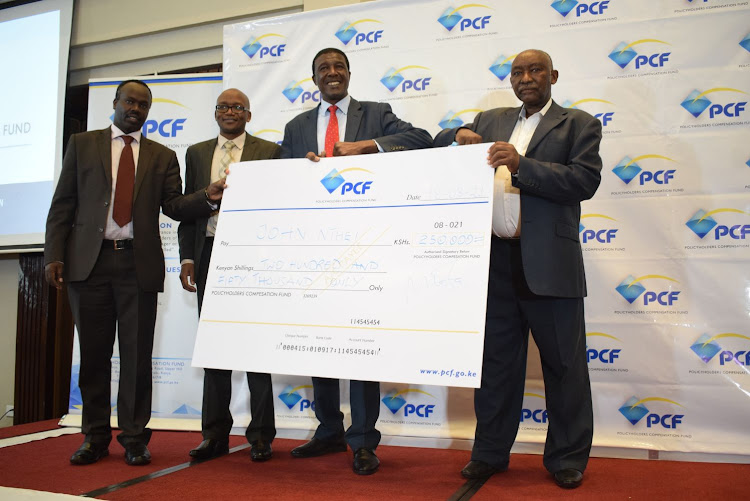

•General insurance business underwriting results however reduced significantly from a marginal profit of Sh62.45 million in the quarter, to a loss of Sh1.46 billion. Insurance Regulatory Authority CEO Godfrey Kiptum, PCF Managing Trustee William Masita and National Treasury CAS Nelson Gaichuhie pose with a Concord insurance claimant John Nthei in Nairobi, on August 18, 2021/ More businesses and individuals sought insurance in the second quarter of this year compared to last year, industry data shows.

This shows recovery of the economy from the Covid-19 pandemic which led to loss of income after hundreds of businesses in Kenya closed or scaled down operations.

Some of the sectors hard-hit include tourism and hospitality, education, international trade and SMEs in different sub-sectors of the economy.

Households have also been affected with job losses and deaths, which has seen an increase in the uptake of long-term policies including life assurance.

Insurance premiums went up by 19 percent in the second quarter of 2021 to hit Sh144.02 billion compared to Sh121.04 billion same period last year, Insurance Regulatory Authority(IRA) data shows.

This came even as general insurance business underwriting results reduced significantly from a marginal profit of Sh62.45 million in the quarter, to a loss of Sh1.46 billion.

It is attributed to high increase in loss ratios due to relaxation of restrictions that had been imposed on travel due to Covid-19 pandemic.

According to IRA, general insurance business remained the largest contributor to industry insurance premium, contributing 59.3 per cent of the total premiums at Sh85.36 billion.

This is non-life insurance policies, including automobile and homeowners policies, which provide payments depending on the loss from a particular financial event.

Long-term insurance premiums stood at Sh58.66 billion in the period under review.Claims incurred in the general insurance business amounted to Sh32.38 billion during the period , a 15 per cent increase from Sh28.08 billion reported in the second quarter of the previous year.“The high premium volume classes of general insurance business contributed the largest proportions of incurred claims; medical (38.7 per cent), motor private (29.8 per cent) and motor commercial (22.8 per cent),” IRA noted in a statement yesterday.Motor classes of insurance business comprised of 52.7 per cent of total claims incurred compared to their contribution of 27.8 per cent of the total premium under general insurance business.The claims paid increased by 16.9 […]