A rally at the Uganda Clays Ltd (UCL) counter since October has worn off as speculation eases over anticipated compensation for lost deposits affected by a road project and conclusion of a debt-to-equity deal by the National Social Security Fund (NSSF).

The company’s share price gained 60 per cent in two weeks last month on the back of speculation over compensation for construction of the Kampala-Entebbe expressway, a new 51km highway that links Entebbe to Kampala.

Clays’s share price rose from an average of Ush15 ($0.0041) at the beginning of October to a record high of Ush21 ($0.0057) mid last month.

Its share price surged to another record high of Ush24 ($0.0066) towards the end of October. The company’s share price hit Ush31 ($0.0085) at the beginning of November, as retail investors bought more shares.

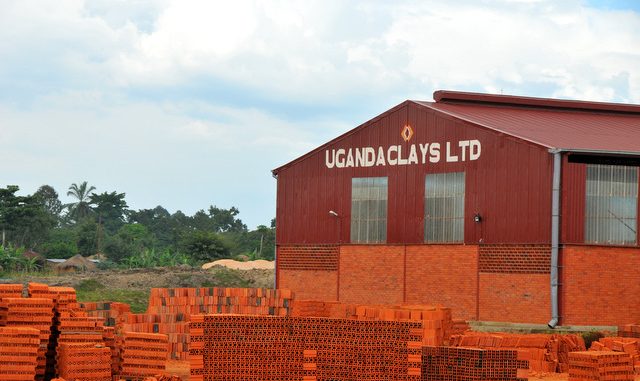

The company’s Kajjansi factory is located near the highway, next to an intersection linking it to Entebbe International Airport, Busega roundabout, the upscale lakeside residential resort of Munyonyo, and the old KampalaEntebbe road.

The road is scheduled to be commissioned next year; about 86 per cent of the civil works have been completed. Though UCL sought compensation for a piece of land affected by the project and received Ush3 billion ($817,807) from the Uganda National Roads Authority (UNRA) in 2016, the company also demanded compensation for the value of clay deposits in the affected area.

The compensation value sought by the company remains unclear, but speculation about negotiations between UCL and UNRA raised hopes of a large payout that triggered a surge in the company’s share price, market sources claim.

The compensation payment was anticipated to fund interim dividends for this year, an expectation generated by retail investors who had benefited from a dividend of Ush1 ($0.00027) per share issued last year. This dividend was reportedly financed by the land compensation payment made by UNRA.

Speculation a second bullish rally was fuelled by speculation over the completion of a debt-to-equity conversion deal related to a Ush22 billion ($5.9 million) loan extended to NSSF Uganda.