Foreign nations lent Kenya a total of 760 billion shillings, ($7.6bn) last year in an aggressive borrowing campaign that has raised the portfolio of the country’s foreign debt to record levels.

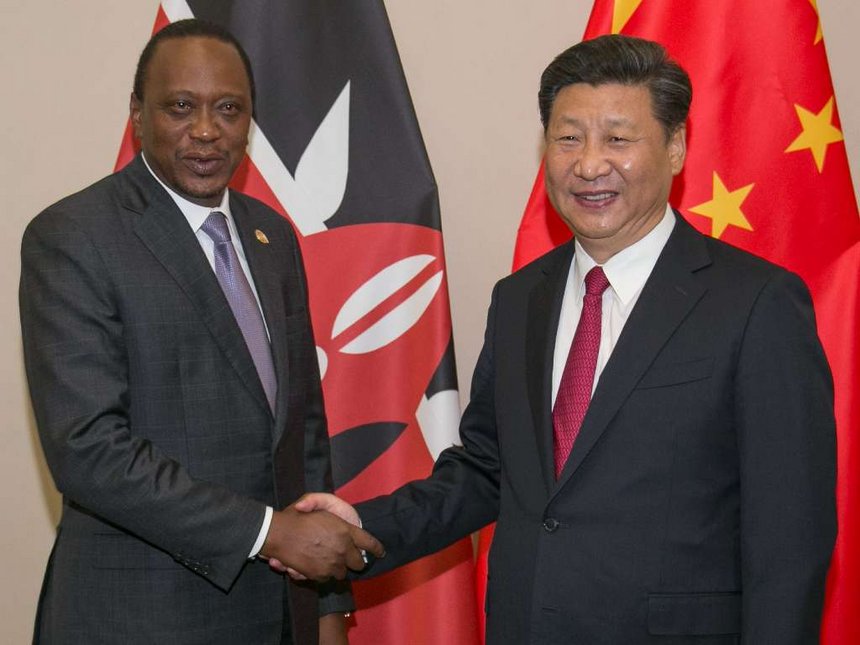

China remains as the top lender to Kenya surpassing institutional lenders such as World Bank, International Development Funds among others with more than 1.5 trillion shillings ($14.8bn) advanced to the east African nation.

The Asian economic giant lent Kenya a total of 525 billion shillings ($5.18bn) according to the foreign debt report compiled by the National Treasury.

China has become the lender of choice for Kenya in the last ten years funding major infrastructural projects like the standard gauge railway line, the Lamu Port among other key major roads in the country.

This pushed the stock of external debt to an all time high of 2.36 trillion ($23.29bn) shillings last year.

This has pushed Kenya’s total debt to 4.45 trillion shillings ($43.92bn) or 42 percent of Kenya’s gross domestic product.

Latest debt sustainability report by the National Treasury indicates that Kenya borrowed a total of 760 billion shillings last year, with China being the source of more than 70 percent of the entire loan portfolio.

The report shows Japan was another top lender to Kenya with 82.5 billion shillings.

The debt stock comprised bilateral debt 33.3 percent, multilateral debt 35.8 percent, and commercial banks’ 30.1 per cent and suppliers’ credit 0.7 per cent.The document says Kenya’s current and projected medium term debt is sustainable despite concerns raised by economist and the international monetary fund.The debt sustainability analysis says in the long term, the ratio of public debt-to-GDP is expected to be 47.9 percent of GDP next year while public debt-to-revenue remains below the threshold of 300 percent throughout the period of analysis.