Darasimi Adebisi

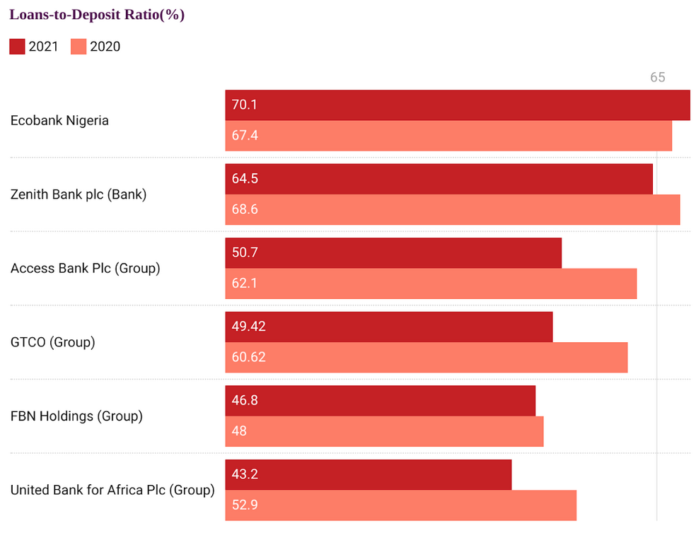

Following concerns over the need to balance between liquidity, deposit-to-lending ratios and check non performing loans, Tier-1 banks in the country failed to meet the Central Bank of Nigeria (CBN) 65 per cent Loans-to-Deposit Ratio (LDR) for the half year ended June 30, 202.

This is despite the CBN warning that failure to achieve the target would continue to attract levies of additional cash reserve requirement of 50 per cent of the lending shortfall of the target LDR.

The Tier-1 banks’ are Ecobank Transnational Incorporated (ETI) with a Nigeria subsidiary, Ecobank Nigeria, FBN Holdings Plc, Access Bank Plc, Guaranty Trust Holdings Company Plc (GTCO), United Bank for Africa Plc (UBA) and Zenith Bank Plc.

Analysis of the banks’ results revealed that in the last two years, they have continued to defy the apex bank LDR policy that mandated lending to real sector.

The apex bank in July 2019, announced an increase in the required minimum LDR to 60 per cent effective end of September 2019.

Upon review of the results of the policy, the CBN decided to raise the ratio higher to 65 per cent which banks were expected to comply with by the end of December 2019.

The CBN in coming up with the policy sought to trigger growth in a weak economy.

Aside Ecobank Nigeria that recorded 67.50 per cent LDR in H1 2021, from 70.10 per cent in H1 2020, all other Tier-1 banks reported LDR below the stipulated 65 per cent demanded by the CBN.

Specifically, Access Bank (Group) reported 51.70 per cent LDR in H1 2021 from50.70 per cent in H1 2020, while Zenith Bank Plc (Bank) LDR dropped to 61.60 per cent in H1 2021 from 64.50 per cent in H1 2020.

FBN Holdings’s (Group) LDR increased to 51.70 per cent in H1 2021 from 47.40 per cent in H1 2020 as UBA ‘s LDR dropped to 41.90 per cent in H1 2021 from 43.20 per cent in H1 2020.

In addition, GTCO (Group) reported 46.28 per cent in H1 2021 from 49.42 per cent reported in H1 2020. The data obtained from CBN website by THISDAY showed that the Nigerian banking industry LDR stood at 61.97per cent as at June 2021.The last time the LDR was above the regulatory threshold was December 2019 when it stood at 68.46per cent. Lenders have been cautious of extending credit to the private sector due to the country’s economic downturn, occasioned by the impact […]