In media, banking, medicine, entertainment and others, preferences by generational groups influence the success or otherwise of organizations. That is why researchers have names like Generations Z, Alpha and X. Among these, Generation Z has an interest in digital things. It is for this reason that they are called “digital natives”.

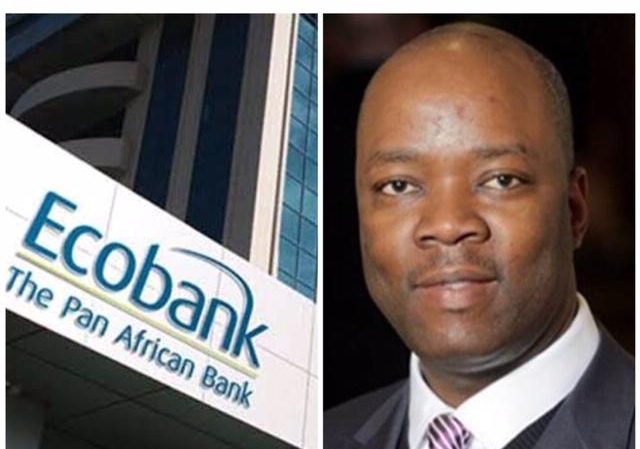

That is why Ecobank is advocating taking advantage of the group in packaging financial products. Chief Financial Officer, Ecobank Nigeria, Ibukunoluwa Oyedeji has advised that banks and government institutions responsible for financial management should ensure millennials are involved in the process of creating and developing new payment solutions. Mrs. Oyedeji noted that the millennials are the major consumers of these products and must therefore be involved in the birthing process if such products are to be sustainable in the marketplace. This, she noted has long been identified by the Fintechs, hence their continued relevance to financial development.

She argued that the millennials, generation z and generation alpha make up 92% of the population of Nigeria which explains what future banking should look like. She cautioned banks, governments and other financial institutions to involve millennials in the decision-making process on future payments solutions, noting that millennials have brought about great disruption in the payment space both as consumers and owners of the products.

According to her, “the meteoric growth of payments, which is much more than corporate and investment banking in the last few years is an indicator of future growth potential as the world moves more and more to digital. The Fintechs are already exploiting the disruptions and have grown exceedingly in the past few years. The combined evaluation of just two Fintech playing in this space exceeds the market capitalization of six Nigerian banks with an average 60 years of operation and a median leadership age of 56. They have understood the needs of these demographics which makes up about 92% of the population of Nigeria currently.”

Oyedeji who made this submission in her presentation: ‘Millennials as Game Changers for Future Payments’ at the recent 14th Annual Banking and Finance Conference of the Chartered Institute of Bankers of Nigeria, maintained that youths have demonstrated a strong entrepreneurial spirit as Nigeria remains one of the top three hubs for fintech investments and activities in Africa which removes the question of skill gap. “For the new generation, it’s about solution and not necessarily product. They are very digital savvy, and […]